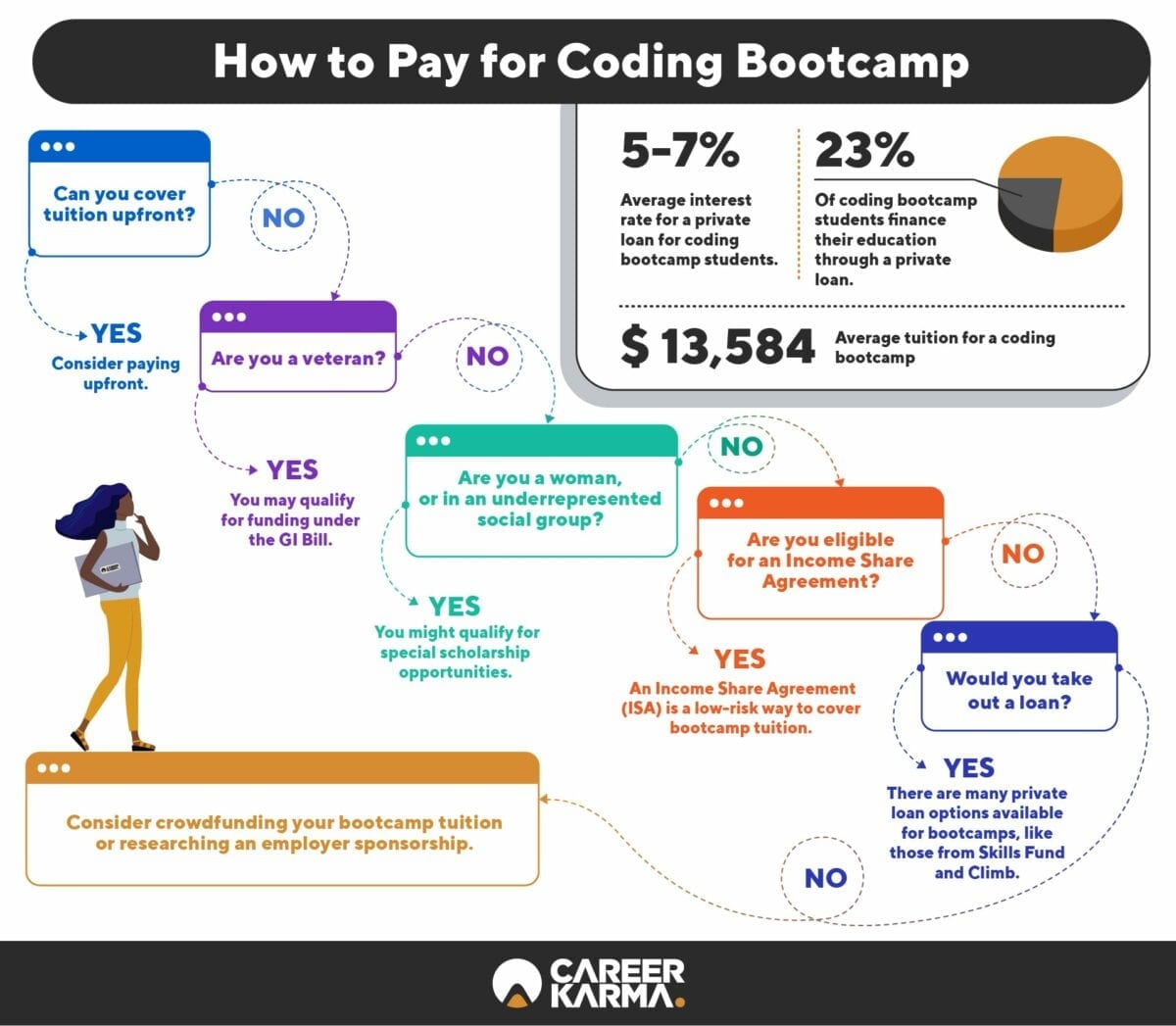

So, while an unsuccessful student won’t find themselves piled with debt and no job to pay it off, a successful student will find themselves making monthly payments that often exceed that of traditional loans, and paying back a higher total than they would have otherwise. In many cases, the tuition cap on an ISA is 1.5x - 2.5x tuition. However, what these proponents often overlook is that if a bootcamp is successful in placing a student, that student will then pay back much more than the tuition price. This alignment of incentives, proponents of ISAs argue, helps hold bootcamps accountable. Thus, by creating an agreement that makes students pay only if they are gainfully employed, an ISA shifts some of that risk to the education provider - if an educator can’t place a student in a good job, they don’t get paid. Any bootcamp student faces the risk that they might not graduate or be placed in a good job to justify the time and money they put into their education. ISAs are fundamentally about risk-sharing. The truth is, for the typical student who graduates a bootcamp and is placed in a good job, they will owe more with an ISA than they would with a loan. The interest rates are based in part on your credit history, so applying with a cosigner can increase your chances of approval and possibly lower how much interest you have to pay. If you have good credit, it’s likely Sallie Mae can give you the best interest rate of any private lender. They offer both variable and fixed interest rate loans for periods between 5 and 15 years with grace periods up to 6 months. You won’t find a loan provider that is more flexible than Sallie Mae. Being approved by Sallie Mae is itself a mark of quality for a bootcamp, as Sallie Mae bases their partnership decisions in part on reliable and transparent outcomes. There are only a handful of bootcamps in the country that Sallie Mae has agreed to work with to offer their Career Training Smart Option Student Loan. It was originally created by the federal government in 1973 but was eventually privatized. Sallie Mae is the largest lender of private student loans in the country. WHICH LENDERS WORK WITH BOOTCAMPS? Sallie Mae And don’t forget to look for a bootcamp that is helpful but fact-based when discussing your lending options. Before you look at different loan providers, make sure you are familiar with basic loan terms like APR and that you understand the factors that affect your credit score and where to find it. Alternatively, there are many lending partners and products on the market that can help you get where you’re going.

Bootcamps may offer installment payments if you prefer to pay in cash or with a credit card, but credit cards can carry fees and cash is not an option for many students. Once you’ve found a bootcamp with transparent outcomes and are ready to begin your career transformation, you can start looking at payment options.

If you are looking at a bootcamp that doesn’t publish their audited outcomes to CIRR, keep in mind that those outcomes are likely not verified by a third party and may not be entirely accurate. To see bootcamps who are committed to transparency in their outcomes, visit the Council on Integrity in Results Reporting ( CIRR). The best way to understand cost is to understand value - what kind of resources can you expect as a student in the program, do they include equipment (a good laptop should cost over $1,000), and most importantly what’s the outcome? Real value comes from return on investment and that comes back to transparent placement outcomes. A quality bootcamp isn’t cheap, but that doesn’t mean that a bootcamp’s tuition price is a direct reflection of quality. Before we discuss the different ways to fund your bootcamp tuition, it’s important to consider what you are really looking for in a bootcamp.

0 kommentar(er)

0 kommentar(er)